Award-winning PDF software

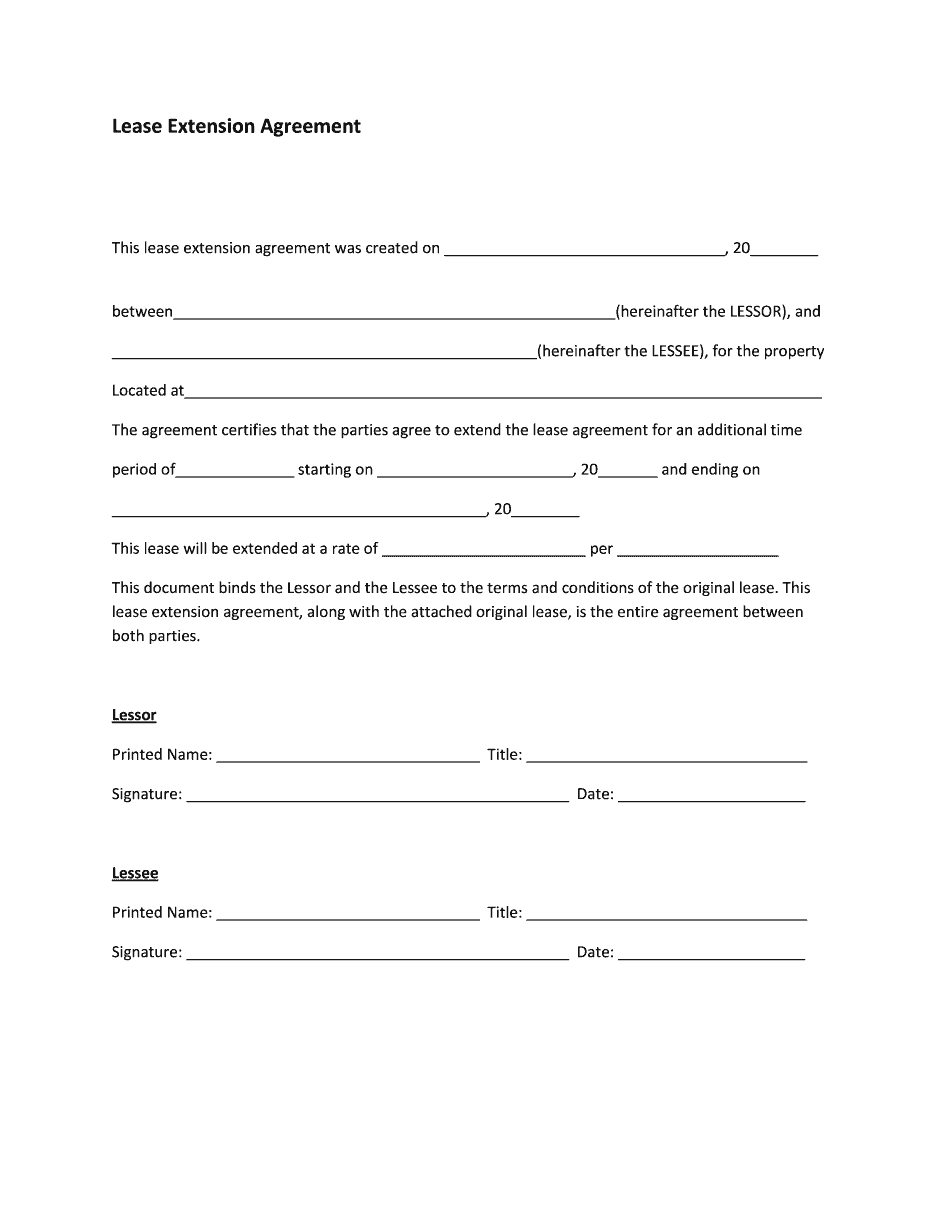

Georgia Residential Or Rental Lease Extension Agreement: What You Should Know

Form W-10, Annual Report to Shareholders — SEC The Form W-10 must be filed (with tax) the due date for any income taxes it received during the previous year. This form is useful in providing any information Form W-2, Wage and Tax Statements — IRS Filing Form W-2 and completing your federal tax forms does not guarantee that the business will receive the minimum tax payment. It is mandatory the employer file and pay for the federal income tax due each year. The IRS does not have information about any tax due without your name attached. Your Employer: If you are filing a Form W-2 for your business, you know your employer is required to withhold Social Security and income tax from your wages. If you are an individual, you will also be aware that you and your employer must file federal income tax returns together. A Form W-2 allows you to withhold from your pay and report to the government the same information that is on your Form 1040-EZ (Individual Income Tax Return). Employers also report the wages to the IRS and file a W-4. Employers filing a Form 8332 are required to provide information on their business to the IRS. This information includes: business location, hours, locations, names of employees, and employment periods. When to Submit Your Employer Forms (Form W-3 and Form W-2) — Forms W-3 and Forms W-2 Filing — Social Security For your business to receive payment from the IRS for the amounts withheld, it must receive Form 1099 by 6:00 a.m. If you do not receive Form 1099 by 6:00 a.m., contact the IRS Taxpayer Advocate Service (TA-SAS) for additional information. Form 1099 is the quarterly tax payment to the IRS. The amount you receive from the IRS may be reduced if you are a small business, and you are still delinquent on federal income tax payments. Business Taxpayers: When you file your federal income tax return, your withholding is calculated based on the income earned by your business. If you are the owner or employee of a business, your Form W-2 should indicate income you withheld. Some business forms require that you submit a separate tax form for small business. Some states require business owners and employees to file separately. Each state requires that the business pay certain taxes and fees in addition to the taxes they already are responsible to pay. These fees vary by state.

Online remedies make it easier to to organize your document administration and raise the efficiency of your respective workflow. Follow the fast help with the intention to comprehensive Georgia Residential or Rental Lease Extension Agreement, stay away from faults and furnish it in a well timed way:

How to complete a Georgia Residential or Rental Lease Extension Agreement on-line:

- On the web site using the type, click Begin Now and pass towards editor.

- Use the clues to fill out the related fields.

- Include your own material and call data.

- Make guaranteed you enter accurate knowledge and figures in proper fields.

- Carefully verify the subject matter from the sort also as grammar and spelling.

- Refer that will help segment should you have any problems or handle our Support workforce.

- Put an electronic signature in your Georgia Residential or Rental Lease Extension Agreement with all the assistance of Signal Resource.

- Once the form is finished, press Carried out.

- Distribute the prepared type by way of electronic mail or fax, print it out or preserve on the gadget.

PDF editor allows you to definitely make adjustments on your Georgia Residential or Rental Lease Extension Agreement from any world-wide-web connected machine, customize it based on your needs, sign it electronically and distribute in numerous strategies.